UP Industrial Investment & Employment Promotion Policy 2022

Incentives to Industrial Units

| Categories | Capital Investment |

|---|---|

| Large | Above ₹50 Cr but below ₹200 Cr |

| Mega | ₹200 Cr or above but below ₹500 Cr |

| Super Mega | ₹500 Cr or above but below ₹3,000 Cr |

| Ultra-Mega | ₹3,000 Cr or above |

Stamp Duty Exemption

- 100% in Bundelkhand & Poorvanchal,

- 75% in Madhyanchal & Paschimanchal (except Gautam Buddh Nagar & Ghaziabad)

- 50% in Gautambuddh Nagar & Ghaziabad districts

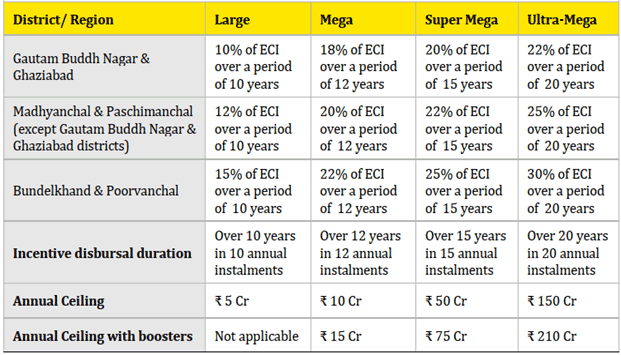

Investment Promotion Subsidy

A one-time choice of choosing one option between three mutually exclusive options during the time of application. One additional chance of changing the Option after the application has been processed by the Evaluation Committee and is pending for the approval of the High-Level Empowered Committee or the Empowered Committee, as the case may be.

- Option 1: Capital Subsidy with boosters

Capital Subsidy = Base Capital Subsidy X Gross Capacity Utilisation Multiple (GCM) + Additional Capacity Subsidy

- Base Capital subsidy is as follows –

Gross Capacity Utilisation Multiple (GCM) = Minimum of (75%, Peak Capacity Utilisation of the considered year)/75%

- The GCM shall be considered as 1 for first year provided the capacity utilization for the unit is 40% of the installed capacity.

- For the subsequent years GCM shall be considered as 1, provided the peak capacity utilisation of that year is 75% or more of the installed capacity.

- In case the peak capacity utilisation is less than 75%, the GCM shall be proportionately reduced

- Additional Capacity Subsidy in the form of Boosters

Annual Capital Subsidy = [(Base Capital Subsidy X GCM) + (Employment Booster + Exports Booster + Ecosystem Booster)]/ applicable Incentive disbursal duration

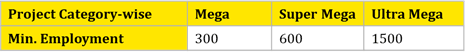

- Employment Booster: Average annual employment to be considered as follows

- On minimum or 75% women of min employment for the given project category – Booster of 2%

- On employing more than twice the min. or 75% women of twice the min employment for the given project category – Booster of 3%

- On employing more than thrice the min. or 75% women of thrice the min employment for the given project category – Booster of 4%

- Exports Booster: Determined as a ratio of revenue from exports to total revenue for a given year, as follows –

- More than or equal to 25% of its production through exports – Exports Booster of 2% of ECI

- More than or equal to 50% of its production through exports – Exports Booster of 3% of ECI

- More than or equal to 75% of its production through exports – Exports Booster of 4% of ECI

- Ecosystem Booster: On procurement of any input/ raw material for manufacturing its final product from any existing or new manufacturing unit within Uttar Pradesh, as follows –

- 40% to 60% of its total raw/input material requirement – Ecosystem Booster of 2% of ECI

- 60% to 75% of its total raw/ input material requirement – Ecosystem Booster of 3% of ECI

- More than 75% – Ecosystem Booster of 4% of ECI

- Option 2: Net SGST Reimbursement

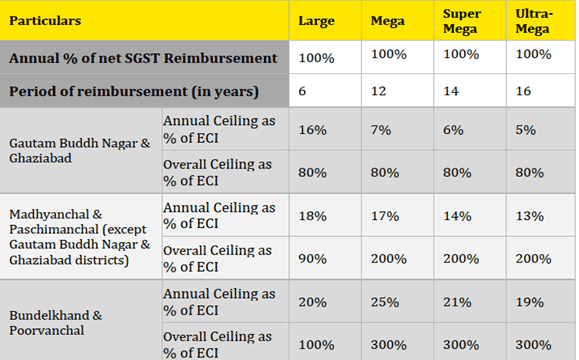

Net SGST Reimbursement: Reimbursement of 100% of the net SGST amount deposited in State’s account, subject to following

- Option 3: PLI Top-up

Top up on incentives received under PLI Scheme of Government of India

- 30% of the PLI incentives (as and when disbursed by GOI) sanctioned under any PLI Scheme of Government of India Scheme

- An overall ceiling of the incentives to be capped at 100% of ECI

Case-to-case incentives

- Government may consider providing customized package of incentives on case-to-case basis as deemed necessary for projects of special importance.

- Kind of such projects eligible for case-to-case basis incentives shall be approved by the Cabinet

Incentive for R&D projects and Intellectual Property Rights

- Reimbursement of 25% of the expenditure (up to a max. of ₹10 Cr) for standalone R&D units. Max. 10 units over the policy period to be incentivised

- Reimbursement of 50% of the expenditure (up to a maximum of ₹1 Cr)incurred for registration of patent, copyright, trademarks, and Geographical Indicators as a result in-house R&D – for manufacturing units and standalone R&D eligible units

Financial grant to Centres of Excellence (CoE)

- 50% of the project cost up to ₹10 crores.

- Private companies/ PSUs/ Govt Centres of Excellence (CoE) which are not entitled to any benefits under any of the policies

- Max. 10 such COEs in the policy period with a cap of max. 2 CoEs in a sector.

Incentives to Infrastructure projects

(E.g. Pumped Storage Plants (PSP); Other projects may be added from time to time)

- Eligible Investment size = Mega and above category

- Incentives: Stamp duty reimbursement; Base Capital Subsidy (as per Option1, without GCM & any boosters)

Incentives to Private Industrial Parks

Incentives to developers of Private Industrial Parks (Having min. 5 units with no single unit occupying more than 80% of the total allocable area):

- 20 acres or more in Bundelkhand & Poorvanchal and 30 acres or more in Madhyanchal and Paschimanchal

- Capital subsidy @ 25% of ECI (except land cost) – Max. up to ₹40 Cr in Madhyanchal & Paschimanchal, ₹45 Cr in Bundelkhand or Poorvanchal

- Capital subsidy @ 25% of the cost of Hostel/ Housing (except land cost) for workers in the Industrial Park – Max. up to ₹25 Cr

- 100% exemption on stamp duty on the purchase of land

- More than 100 acres

- Capital subsidy @ 25% of ECI (except land cost) – Max. up to ₹80 Cr

- Capital subsidy @ 25% of the cost of Hostel/ Housing (except land cost) for workers in the Industrial Park – Max. up to ₹50 Cr

- 100% exemption on stamp duty on the purchase of land

- 70% of incentives will be released on completion of park development, the next 10% on completion of allotment of envisaged plots and the final 15% after the units in the park start their commercial operations.

Facilitating land aggregation for Private Industrial Parks

- Government will facilitate private players in land acquisition outside Industrial Development Authorities, Housing Development Authorities, Urban Local Bodies or other notified areas

- Applicable for Private Industrial Parks of more than 100 acres and having min 5 units with no single unit occupying 80% of the allocable industrial area

- Towards this, a License will be provided on acquisition (with registered sale deed) of 25% of total proposed land area. No map approval to others in such licensed areas and development/ construction to be controlled. The developer will have exclusive rights of development/ construction in the licensed area.

- Detailed Project Report (DPR) to be submitted within 18 months. 60% of the total land acquisition (including land pooling agreement) must be complete by then.

- Map approval after 75% land acquisition (including land pooling agreement) and to be completed within 2 years from license date. UPSIDA will be the map approval agency.

- After 80% of the total proposed land is aggregated by the developer, if any issue is faced in acquisition of remaining land, UPSIDA will acquire the same on submission of Bank Guarantee of equivalent amount.

Fast track Land Allotment

- Preferential land allotment on fast-track basis for following category of investors –

- Super Mega and above category as per DPR

- Mega projects meeting the following conditions:

- Projects with 100% Foreign Direct Investment

- Companies featuring in Fortune Global-500 in last 3 consecutive years

- Companies featuring in Economic Times-200 in last 3 consecutive years

- Companies featuring in Forbes Global-2000/ Asia best – 200 companies in last 3 consecutive years

- Large+ category projects which are industrial PSUs of any State/Central Govt with majority Govt holding

- In industrial areas where direct land allotment is allowed, the concerned IDA will directly allot the plot in favour of investor. In case of multiple application, highest investor will be allotted.

- In Industrial areas where land is allotted through auction, land will be allotted directly at Base rate of the Plot + additional 15% of the base rate. In case of multiple application, highest investor will be allotted.

- In areas outside any IDA/ DA or Urban Local body, State to acquire land 1.25 times of that required by eligible unit so that a minimum of 4 more industrial units can be set up in the additional land so acquired and an industrial area can be developed

Enabling Land Ban

- Pooling of non-agricultural, barren and uncultivable land for industrial use

- Provide banzar Gram Samaj (GS) land/eligible government land on lease of 30 years

- Amending provisions of Revenue Code viz. converting agricultural land into non-agricultural land, change of land use, exchange of GS land with private land, Permission for establishing industries on SC land etc.

- Unlocking of land bank owned by government/ state public sector sick units

- Develop web enabled platform for lease or sale of encumbrance free land for industrial purpose.

- Vesting of GS land located within the Industrial Development Authority areas without any charges.

- Issue instructions under UP Revenue Code 2006 to allow resumption of GS land in the State to Industrial Development Authorities without any charges.

- Strengthen the Land Pooling Policy 2020 to enable creation of land bank.